Paid leave for families in Washington helps some, frustrates others

Listen

(Runtime 3:50)

Read

More than 430,000 people have used Washington’s Paid Family and Medical Leave Program since its launch in 2020. However, program staff said the program has had its challenges because of COVID and a higher volume of applicants than anticipated.

The surge of applications caused the program to put outreach and marketing on pause. In early 2024, staff said the program will have additional staff to handle outreach.

“We’re working with community-based organizations and healthcare providers to make sure they have the information they need to help their clients, patients and communities,” said Alison Eldridge, a transformation manager in the Leave and Care Division of the Washington Employment Security Department.

The program allows parents to use the leave anytime in the first year after the baby is born. Benefits apply even if the dedicated parent works in one state but lives in another.

“As long as you are working for a Washington employer and your work is within the state of Washington, where you live does not matter,” Eldridge said.

Leave available to Washington workers through the program includes:

- Up to 12 weeks of medical or family leave

- Up to 16 weeks of combined medical and family leave if a person has more than one qualifying event in the same claim year (such as giving birth and then taking bonding leave)

- Up to 18 weeks of combined medical and family leave if someone experiences a condition with pregnancy or childbirth that results in incapacity (such as being put on bed rest or having a C-section).

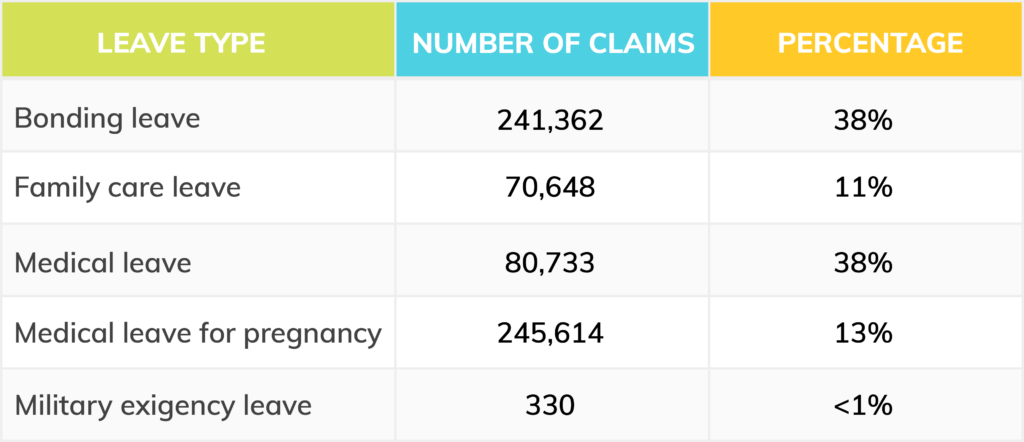

Internal data from the Washington Employment Security Department shared with NWPB shows the number of claims for different types of leave. The numbers reflect the amount of claims from Jan. 1, 2020 to Dec. 5., 2023. (Credit: Rocio del Pilar Benavides / NWPB)

“Between Jan. 1, 2020 and Dec. 5, 2023, we’ve approved applications for and made benefit payments on 638,687 claims to 435,134 people,” Eldridge said.

Prior to June 2022, Eldridge said the program couldn’t distinguish pregnancy-related medical claims from all other medical claims.

“There are likely pregnancy-related medical claims counted in the medical leave category from the first two years of the program,” she said.

Long wait times, complications between state and employers

The program allows parents to use the leave anytime in the first year after the baby is born or a child is adopted. Getting those leave payments in a timely manner is still a challenge for some.

Consider new parents Hannah Sweet and Austin Hengen.

Their apartment is filled with holiday decorations, baby stuff and the cooing sounds of their five month old, Hailey.

“Preparing for [the birth], the first thing we did was look into the paperwork and get online,” Sweet said. “But you really can’t do anything until you’ve given birth.”

Sweet and Hengen submitted the paperwork for leave about six days after Hailey was born.

“I think it was six or seven weeks before we actually got our first payment,” Sweet said.

Baby Hailey sits on Hannah Sweet’s lap (left) while Austin Hengen stands behind them at the couple’s apartment in Moscow, Idaho. The family said they waited weeks for their first leave payment. (Credit: Lauren Paterson / NWPB)

The people at the state agency helped answer questions she had, Sweet said. However, the couple had to rely on savings while they waited for the money.

Hengen eventually decided to return to work. “The week I went back to work is when they finally approved everything,” Hengen said.

Now, because of the program both parents are home and spending time with Hailey.

Washington was the first state where the Paid Family and Medical Leave Program had to be built from scratch, Eldridge said, and the fifth state in the nation to launch its own program.

“We understand there are pain points that people experience with the program with the accessibility of the benefit,” Eldridge said.

Privacy laws surrounding medical information can sometimes complicate what the state program can share with employers, which can cause issues and slow-downs, Eldridge said.

In the last session, legislators made it possible to allow new technology to give current employers more information about how Washington employees are using the leave.

“The hope is that now employers will have a bit more information and be able to assist their employees with filing the paperwork or any questions they might have,” Eldridge said.

The new technology to help employers will launch Jan. 1, 2024.

Despite ongoing changes to the program in an attempt to make it easier to use, there are still kinks to work out. Hengen said he got a troubling email in November.

According to the email, the IRS declined to give guidance on the taxability of paid leave benefits in Washington.

Based on states with similar programs, it’s likely that family leave benefits will be taxed, but medical leave benefits would not, according to the email.

A payroll premium paid for by employees and employers with more than 50 employees funds the program, according to the state website.

Hannah Sweet (pictured here with baby Hailey) said she would like to give her child siblings, but she is not sure she can afford to. (Credit: Lauren Paterson / NWPB)

If the couple is taxed on the money they receive from the program, Hengen said, that’s like paying twice.

Eldridge said the state still doesn’t know whether the IRS will consider paid leave benefits “taxable income.”

Moreover, Hengen said, Washington state isn’t doing enough to let residents know the program exists.

“We had to hear about it from the grapevine, basically,” Hengen said.

Hengen’s brother is a new dad, too, but Hengen said his brothr didn’t use the program at all because he didn’t hear about it.

Eldridge is hopeful the new outreach plans for next year will help with some of these issues.

Although the Washington program is better than what most other states offer, having a child is still a challenge, Sweet said.

The family’s finances have changed for the foreseeable future, she said, referring to the addition of a child.

“I’m a stay-at-home mom now. For us, the cost of daycare was equal to what I was making. It didn’t make sense for me to go to work and essentially pay someone else to raise Hailey,” Sweet said.

An election year could mean talk of a federal parental leave program

“I’m sure as the next presidential campaigns start really picking up speed, the topic will rise to the top of the list and generally does during the campaign season,” Eldridge said.

For now, Eldridge encourages people in Washington to use the program.

In addition to parental leave, if someone who works in Washington is taking care of a family member during an illness or recovery, that caregiver can use the leave program for that too, Eldridge said.

“Any serious health condition that causes you to be unable to work, you also can use the leave,” Eldridge said.

The definition of family member was designed to be expansive and can include children, parents, step-parents and grandparents, Eldridge said.

“Chosen family would also coudn’t in a lot of circumstances,” Eldridge said.

Changes to make the program easier to use will keep happening as more people use it, and the agency gets more information on what’s working and what needs to be fixed, Eldridge said.

“We want people to be able to access and use the benefits,” Eldridge said. “People pay into it. They’ve earned it.”

The program has paid approximately $4.15 billion in benefits to Washington workers over the past three years, Eldridge said.