A Budget Deal By June 30? Key Washington Lawmakers Say It’s Realistic

Listen

There are just 10 days left in Washington’s second legislative overtime session. And still there’s no sign of a budget deal.

Senate Republicans and House Democrats are trying to hammer out a deal on a state budget for the next two years, plus an education funding plan that will satisfy the state Supreme Court.

Time is running out to get a compromise deal by the end of the special session next week. But Senate budget chair John Braun said by June 30—the end of the fiscal year—is realistic.

“I don’t think either side is interested in the prospect of shutting government down or continuing this operation,” he said. “We really want to wrap up our work here. It is unfortunate that it’s taken extra time, but it is a very complicated problem to solve and people are really trying to solve it.”

Braun’s counterpart in the House, Democrat Timm Ormsby, agreed.

“We’ve got some ground to cover, but we’re both confident in getting done,” he said.

If there’s no deal by next week, Gov. Jay Inslee will have to call a third special session.

9(MDAyOTk4OTc0MDEyNzcxNDIzMTZjM2E3Zg004))

Related Stories:

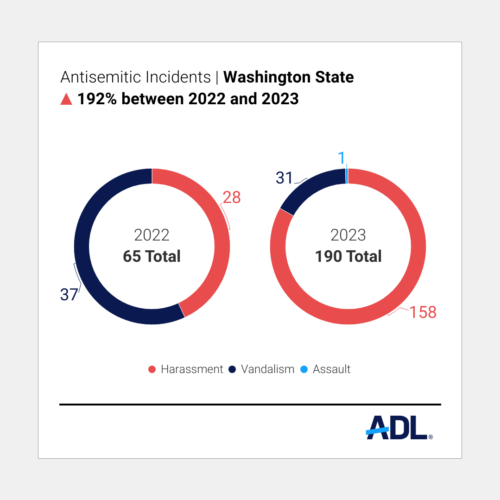

Audit finds marked increase in antisemitic incidents

According to a new report released April 16, by the Anti-Defamation League, 2023 had the most reported incidents of antisemitism nationwide since the organization began tracking incidents of antisemitism in 1979.

Last year, there were 8, 873 reported incidents of antisemitism nationwide, which the organization averages to one incident every hour.

Continue Reading Audit finds marked increase in antisemitic incidents

Nueva ley de WA sobre DEI en educación divide a residentes de Prosser

Las escuelas de Washington deben incluir en sus planes de estudios la historia y las contribuciones de grupos marginados y poco representados en el marco de la diversidad, la igualdad y la inclusión. Sin embargo, en Prosser, la ley recién aprobada ha causado divisiones. Continue Reading Nueva ley de WA sobre DEI en educación divide a residentes de Prosser

Bird flu in cattle stressing Northwest dairy operators

Barley, a Jersey cow, and some of her herdmates on pasture last spring at Steensma Dairy & Creamery. (Credit: Steensma Family Dairy & Creamery) Listen (Runtime 1:06) Read Some Northwest… Continue Reading Bird flu in cattle stressing Northwest dairy operators